4-Numbers Moroccans should track to increase their wealth

Growing up I was never taught how to manage my finances. Neither my parents or the schools I went to taught me how to spend the money I earn. That’s why I felt right inside the rat race.

For those who don’t know, the rat race refers to a relentless, competitive struggle or pursuit of wealth.

In financial literature, being in the rat race means that regardless of the income you earn, you end up spending it, putting you in a never-ending cycle of waiting for the next salary to arrive.

This is why I decided to do something about it and found out how to successfully manage my income.

Now before we dive into this article, here’s what to expect from this blog post :

You will get a FREE tool that allows you to manage your income based on the 4 numbers you should track as stated by Ramit Sethi, personal finance adviser and author of NY Times Best Seller I will teach you to be rich.

- 4-Numbers Moroccans should track to increase their wealth

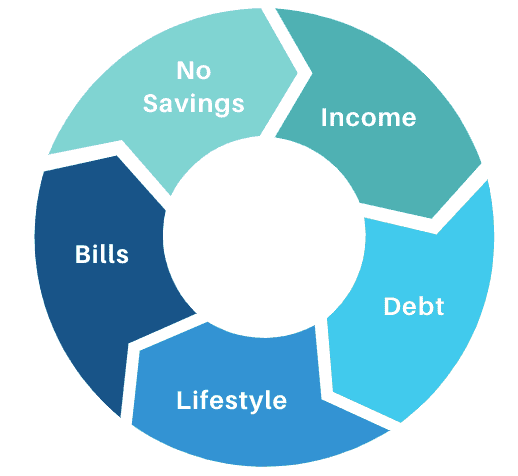

The 4 numbers that will make you wealthy

Fixed Cost

Fixed Cost is all of the expenses that are necessary to your everyday life :

- Rent or Mortgage

- Debt Payments

- Groceries

- Internet and Phone Bills

- Water and Electricity Bills

- Transportation fees

- etc …

Fixed Cost expenses should be around 50% to 60% of your income.

Savings

Savings is the amount of money you keep on a high saving rate account. This should be around 5% to 10% of your income.

Having money saved will help you feeling secure during those harsher days and trust me, you can find a way to save at least 5% of your income, even if you’re in the lowest part of the income bracket.

Here are some few tips that will help you save efficiently :

- Pay yourself first : This means saving should be the first thing you do when you get your salary. Yes, even before paying your internet bill.

- Make it automatic : Set up a recurring payment to make it seamless.

- 6 Months of income : This means your should not save eternally. 6 months of income saved goes a long way. Try to do it step by step. 3 months of expenses, then 6 months of expenses, finally 6 months worth of income saved.

Investments

This is where your wealth is created. This should also be around 5% to 10% of your income.

We will not dive deep into investing in this article since it’s related to risk but here is the types of investments you should consider as a beginner (after doing your own research obviously. This is not financial advice.) :

- ETFs (Exchange Traded Funds)

- OPCVM

- MASI20

If you want to dive deeper into investing I would suggest you start by learning about the compound effect. Often coined as the 8th wonder of the world, it refers to the principle where small, consistent actions or changes, when done repeatedly over time, result in significant cumulative outcomes or impacts.

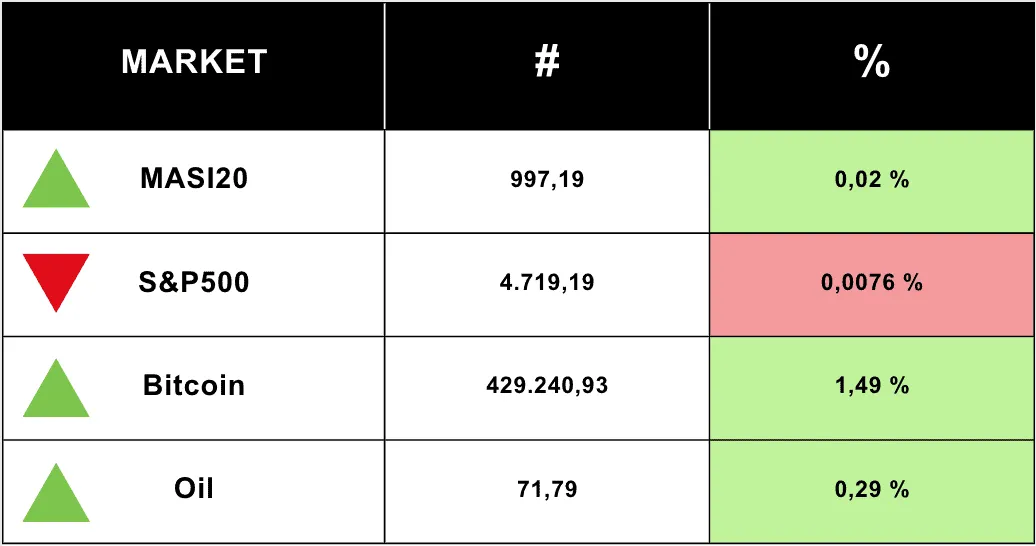

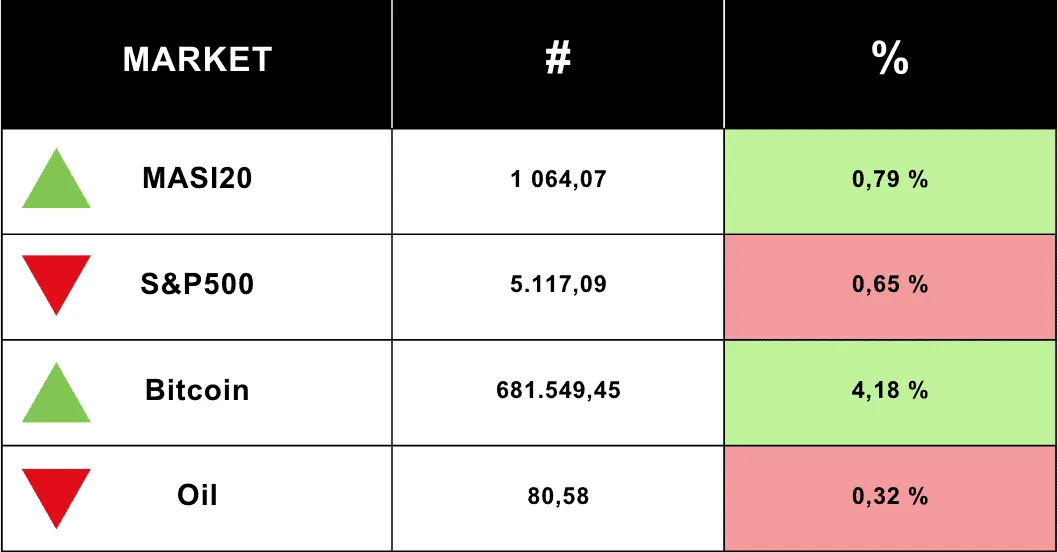

Take for example my newsletter, I send a bite sized lesson to my subscribers every Monday at 11AM Moroccan. And in this newsletter I share the weekly changes in investments such as : S&P500, Bitcoin, MASI20 and Oil.

Now take a look on those numbers when I first started the newsletter …

… And this is this week’s overview of the market.

In exactly 3 months, MASI gained 70 Dhs, S&P 400 $, Bitcoin 260 K Dhs and Oil 9 $. Meaning that had you invested 1000 $ per year in S&P 500 for 20 years at that rate, you would end up with more than 40 000 $ in assets. 20 000 $ more than if you would have just put this amount in a piggy bank.

Guilt Free

And the last number you have to track is fortunately the most fun one. Guilt Free is the amount of money you can spend to do whatever.

Yes and I mean it !

Want to go to lhammam everyday ? Does your Guilt Free purse allow it ? Then be my guest !

Want to treat yourself and your parents to a dinner to a fancy restaurant or even choua ? Suit yourself !

I think you got what I mean. Initially, Ramit originally says that it should be around 20% to 35% of your income. But I personally like to let it open as what’s left from the other 3 amounts we discussed earlier.

The Budgeting Spreadsheet

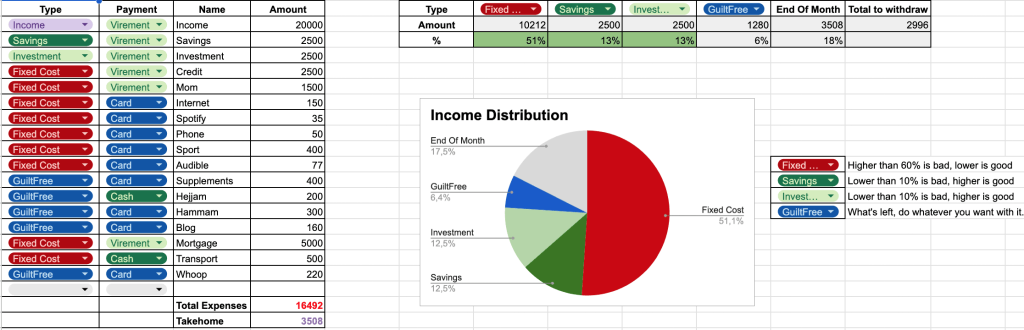

As I promised, and to thank you for reading so far, here is the only Budgeting Tool you will need to sort out your finance.

This is what it looks like

Now let me walk you through the spreadsheet.

What you will find inside the spreadsheet

3 Sheets :

| Start Here | As the name implies, this is where you should start reading, it will give you instructions about the spreadsheet. |

| Example | This shows you how the spreadsheet works once everything is filled. |

| Budgeting | The only sheet you really need, once you filled everything you can delete all other sheets and only keep this one. |

What to do

- Make a copy of the document so you can start editing it privately.

- Read the instructions in the first page.

- Start filling the empty fields.

F.A.Q

How many times do I have to check the sheet ?

It depends, I would suggest at least once a month just to adjust the numbers.

I don’t have enough categories on the excel.

You should have enough, try not to overwhelm the sheet with detailed expenses such as “Fast food” and “Meal Prep” or “Groceries”, rather group them as “Food”.

How do I differentiate between Guilt Free and Fixed Cost ?

That’s a very good question. Some would consider some expenses such as “Gym” as Fixed Cost, I don’t and I advise you not to.

Consider Fixed Cost for things that answer the question : Do I need this to survive ? or Will I be in trouble if I don’t pay this ?

For all other things that you enjoy doing, put them as Guilt Free expenses.

Spender Profile

Now that you know these 4 numbers and how track them, you will know what type of spender you are.

Here are some archetypes :

| The Enjoyer 🦗 | The Frugal 🐜 | The Average 🐞 | |

| Fixed Cost | 60% | 45% | 50% |

| Savings | 5% | 20% | 10% |

| Investments | 5% | 20% | 10% |

| Guilt Free | 30% | 15% | 30% |

To sum things up

Here is the link to the sheet in case you missed it. Remember that managing your finance is not that hard.

It is more behavioral than mathematical.

This means that this tool helps you visualize what type of spender you are.

No matter if you are frugal, extravagant or just average if you follow those simple steps you will progress.

Just remember to :

- Track once

- Stick to your spending profile type

- Pay yourself first

- Save up to 6 months of income

- Invest

And voilà, this is how you manage your finance as a beginner in Morocco.

Note that this applies to every income. Yes, even if you earn as low as 2 000 Dhs a month or make as much as 100 000 Dhs a month.

Just trust the process.

Leave a comment